The Institutions are Here. Bringing TradFi to Defi: Built by R3, Powered by Solana.

A new financial infrastructure – the internet capital markets – is emerging. But a key participant has been missing until now: the traditional financial system. R3’s new direction brings TradFi to DeFi.

R3’s Corda ecosystem is the world’s largest live network of TradFi blockchain platforms. It powers tens of millions of transactions each month, securing tens of billions in assets across its live networks. These networks sit at the heart of global finance and play a key role in the evolving financial infrastructure.

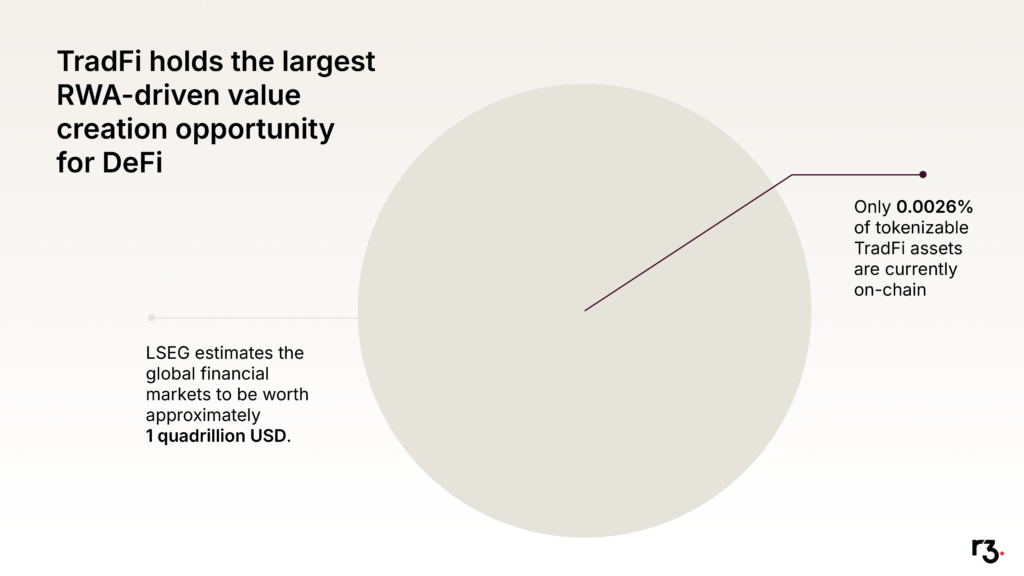

Today, R3 and the Solana Foundation announced that these private networks – and the banks and market infrastructures behind them – will soon connect directly on Solana mainnet. This means Corda users will be able to confirm transactions on Solana, settle trades using stablecoins and other top-tier assets, and bridge real-world assets into DeFi. The timing couldn’t be better. A recent EY-Parthenon survey found that the majority of institutional investment firms plan to invest in tokenized assets by 2026. Over half said that regulatory clarity and institutional participation will be the key catalysts for digital asset growth. And yet, only 0.0026% of tokenizable TradFi assets are currently on-chain.[1] The potential is enormous – waiting to be unlocked.

In this post, I’ll share what we’re building and why we’re doing it now. I’ll explain why these networks were private to begin with, what’s changed since we began our work a decade ago, and how regulatory clarity, market maturity, and Solana’s rise make 2025 the year it all comes together.

The time for TradFi to converge with DeFi is now. The collaboration between the Corda and Solana communities brings together the world’s largest permissioned blockchain ecosystem and the most credible permissionless network. The era of the internet capital markets has begun.

What’s the problem we’re solving?

The banking industry was one of the earliest adopters of computing, going back to the 1950s. That early start helped transform how financial markets operate, making them massively more productive. The IT industry deserves real credit for this progress.

But it’s a good story – not a great one.

There are still two big problems:

First, we optimised at the level of individual firms, not markets. Most banks run on solid tech. But when two banks trade, they still can’t be sure they’ve recorded the same thing. Processes break. Data is siloed, duplicated, or incomplete. Proprietary networks, obscure formats, and fragmented standards persist. These systems predate the internet – and it shows.

Second, banks are victims of their own early tech adoption. Most now run hundreds or thousands of systems – each for a different asset, product, or function. These systems weren’t designed to work together. The result is fragmented data and duplicated logic. Digital, yes. Modern, no.

Blockchain’s promise

Bitcoin offered a glimpse of a better future: a permissionless, global network for recording and transferring value, open to all, where everyone sees the same version of truth.

WYSIWIS: What You See Is What I See.

It was a revelation – an entire market in sync, with trustless transactions across the globe.

Then came Ethereum. It didn’t just move value – it could run code. Business logic on a shared, neutral infrastructure, accessible to anyone.

No wonder technologists in major banks took notice. The idea of running capital markets logic on a shared computer, not owned or controlled by any one institution, was transformational.

Enter R3 and Corda

In 2015, the year Ethereum launched, dozens of banks came together under R3 to reimagine how the world’s financial markets should work. I’ve been Chief Technology Officer at R3 since then.

Back then, though, two things stood in the way:

- Technology

There were red flags everywhere. There was no transaction finality as everything still ran on slow, expensive proof-of-work; languages and tooling were immature; privacy and scalability weren’t fit for finance. - Regulation and perception

Saying “Bitcoin” in a bank meeting could get you side-eye from compliance – if not worse. The crypto brand was toxic.

So, we didn’t wait. We built.

Working with the industry, we created Corda – a blockchain platform purpose-built for finance. And it worked.

Today, Corda powers everything from Italy’s payments system to real-time balance sheet optimization for European banks. Only last week the City of Lugano announced the successful issuance of its fourth native digital bond, using the first digital CSD, which runs on Corda. The ecosystem handles millions of transactions a day and secures tens of billions in assets each month.

Permissioned networks were the right starting point. But they’re not the finish line.

Why permissioned isn’t enough

But it’s also a compromise.

Without public incentives, permissioned projects were harder to fund and slower to evolve. Many Corda networks were standalone, which sped up deployment but limited data sharing and composability – the superpower of public blockchains.

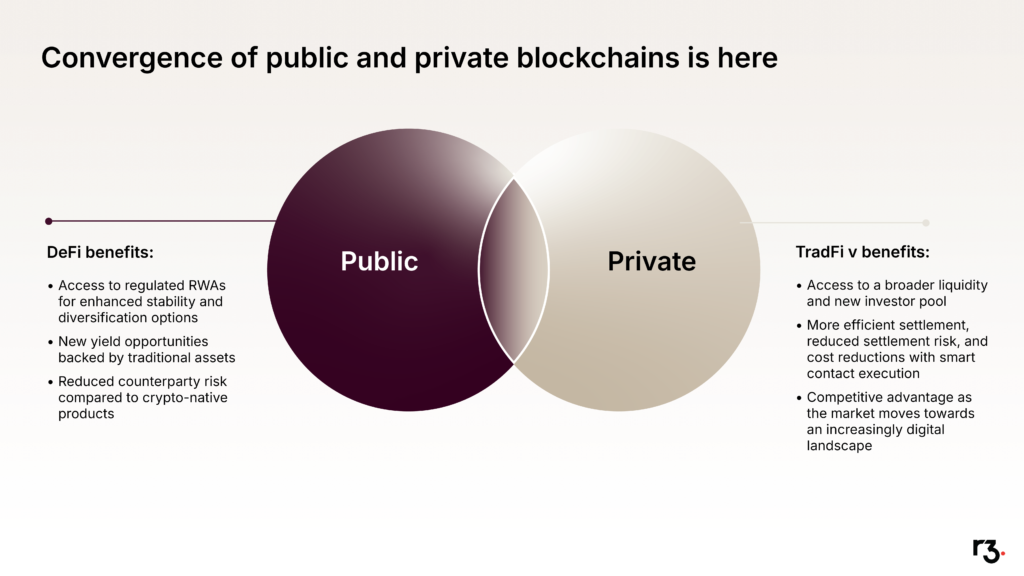

And by avoiding public networks, banks missed out at a business level too. DeFi, stablecoins, tokenized real-world assets – all grew outside the traditional system. A massive new capital base formed, driven by crypto-native innovation. Yet banks stayed on the sidelines.

Time to reconnect

Ten years after Ethereum, R3, and Corda were born, we’ve revisited our assumptions. What’s changed?

First, regulation. Regulators (and therefore banks) are now far more open to responsible crypto engagement. The fear is gone. Caution remains, as it should, but the space has rapidly matured.

Secondly, we now know what works. The Corda ecosystem has proven how to tokenize real-world assets with legal clarity and regulatory confidence. These assets – tens of billions’ worth – are sitting on high-trust, high-integrity networks. Ready to meet demand.

What’s missing? The public layer.

The permissionless world has shown us the power of composability – when disparate assets and logic share a platform, innovation compounds. Incremental improvements, like a new token swap curve, can instantly plug into the existing stack. It’s a self-reinforcing loop that private networks simply can’t match.

But TradFi needed three things from a public chain:

- Scale and cost efficiency

- Reliability and resilience

- Safe, performant programming tools

Solana delivers

With Solana, the world’s most performant and cost-effective public blockchain, those needs are met. Solana brings the infrastructure that global institutions need to scale. It also offers unmatched performance, low fees, and a thriving developer ecosystem. And it speaks a mainstream language, Rust, giving us the tools to write safe, high-assurance programs to manage trillions in value.

Solana is the first public chain that can credibly support the demands of TradFi.

No, not everything should be on-chain. You don’t need your home address on a blockchain. But authoritative, shared records of ownership, status, and settlement of financial assets? That’s where they belong – now the world has a high-performance, neutral platform.

That’s why R3 is moving now. We’re connecting the Corda ecosystem to Solana.

What we’re building

We’re launching three key capabilities:

- Transaction confirmation on Solana

Corda transactions can be confirmed in real-time via Solana’s proven proof-of-stake consensus system – no more Corda ‘notary’ nodes. Yet, thanks to Corda’s unique privacy model, no sensitive data needs hit the public chain. - Settlement with Solana-based stablecoins

True atomic delivery-vs-payment: Corda-issued assets settled directly against Solana stablecoins. No extra protocols. No trusted intermediaries. This will unlock interoperability between public and permissioned networks and expand interoperability between permissioned networks. - A direct liquidity bridge

Corda’s high-quality assets can flow directly on Solana mainnet to meet growing demand for real-world assets and fuel a new wave of DeFi products.

For TradFi institutions, this means faster, cheaper settlement; streamlined operations; new revenue streams from tokenized assets; and a competitive edge in an increasingly digital market. For DeFi, it unlocks access to high-quality, regulated real-world assets – bringing stability, diversification, and yield opportunities backed by traditional finance.

Institutional DeFi starts now

These are just the first steps. But make no mistake: TradFi and DeFi are converging, and this time, the institutions aren’t watching from the sidelines. They’re stepping in.

Institutional DeFi starts now. This is just the beginning. In the months ahead, we’ll share a detailed roadmap for the technical solutions that will make this vision real – bridging institutional-grade infrastructure with the power of public networks.

But here’s the crucial point: to truly unlock the benefits of tokenized real-world assets on public blockchains, TradFi must embrace the elegance of DeFi’s simplicity – not burden these networks with legacy complexity.

Built by R3. Powered by Solana. Shaped by institutions. The internet capital markets is coming – and we’re here to build it right. Want to find out more about our collaboration, simply get in touch.

[1] LSEG estimates the global financial markets to be worth approximately 1 quadrillion USD. As of May 2025, RWA.xyz valued the real-world asset (RWA) market capitalization at around $22.6 billion. This figure therefore represents only a tiny fraction of the total market, highlighting how minimal the current share of tokenized RWAs is compared to the broader financial landscape.